Partners

Partners

Forter

Forter Introduction

-

800M Retention of 800million customer worldwide

-

$200B Yearly transaction processing worth $200B

-

2.3B Perform on 2.3 Billion devices worldwide

-

253 253 countries and localities customer retention worldwide

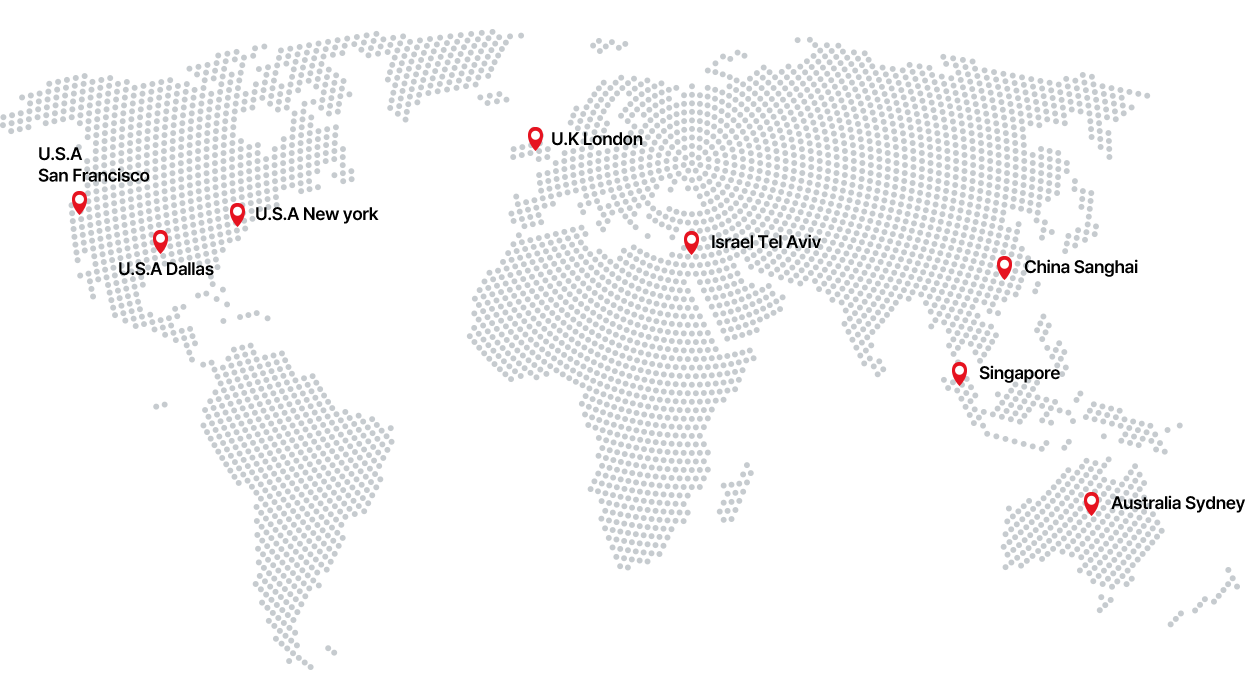

Forter’s Offices

- Challenges for the franchise

-

High denial of payment error: Many franchises refuse legitimate customer transactions due to inaccurate prevention of abnormal transactions.

Expenditure on abnormal transactions: When a merchant cannot accurately identify fraudulent transactions, the cost of payment denial and other related abnormal financial transactions has a significant impact on revenue.

A reactive approach: Suspicious activity prevention teams can often detect suspicious activity after the business has already been impacted. It is important to identify and prevent abnormal financial transactions in advance.

Difficulty in expanding business scale: Many franchises are constrained by inefficient fraud prevention settings to handle traffic spikes, entry into new markets, or new business offerings.

- Forter's Payment Protection Solution

-

Accurately determine the reliability of all transactions, enabling more legitimate transaction approval.

Forter's anti-fraud platform provides completely automated decision-making in real time, allowing customers to do business with confidence.

Forter’s key features

Maximization of profit through fully automated platform

- Reduce cost and operational overhead through automated anti-fraud platforms and obtain more legitimate customers

- save valuable time and resources of the entity by accurate, real-time decision-making

Real-time decision-making to proactively prevent fraud

- Using global seller data and expert research networks to continue fraud prevention and legal activities

Streamline and simplify customer experience

- Minimize unnecessary friction and provide optimal user experience by enhancing security issues only when necessary.

- Extend services offered to customers, including new multi-channel environments, without risk or additional fraud exposure.

Product launch and business expansion

- Execute core business independence without suffering from fraud and abuse.

- Extend fraud protection to successfully grow in new markets and introduce new systems for customers.

Customize anti-cheat capabilities to meet specific business needs

- Through continuous partnerships, anti-fraud solutions are continually aligned to business models, risk savings, service portfolios, and key markets to maximize accuracy.