Consulting and Education

Consulting and Education

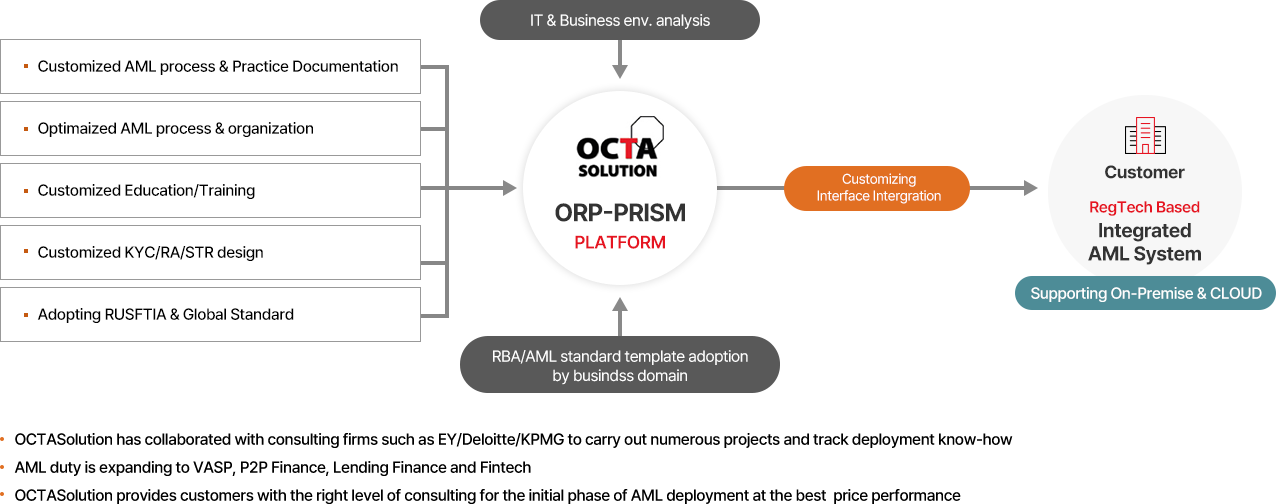

Provide the best cost efficient implementation consulting

Consulting framework

-

1. Environmental Analysis

Business and environmental analysis

Review of regulatory requirements and relevant standards for the level of performance of anti-money laundering operations

Analysis of the work environment considering RUSFTIA(the act on reporting and using specified financial transaction information)/enforcement ordinances and international standards

Support documentation of anti-money laundering business regulations, related policy documents, procedures, etc

Propose optimal processes and organizational frameworks

Design and implement a customized Education program that considers user experience and proficiency

-

2. AML design advancement

Identification of customer (KYC)

KYC Process Guide in accordance with the act on reporting and using specified financial transaction information /Enforcement Decree and FIU Notice AML/CFT Operations/Supervisory Regulations

Risk Assessment (RA)

Designing and advancing customer risk assessment models

Define standard number

Trade Monitoring Service (TMS)

Design applicable STR Scenario

Initial threshold setting and simulation

Continuous STR rule model management and reporting management measures are derived

Internal Control (IC)

Guide on Education, manual, internal audit system establishment

Guide on establishing AML roles and business procedures between field departments, compliance support and internal control departments

Guide on KYE system establishment

-

3. RBA Risk Assessment Design

Risk identification and classification

Risk Assessment List Guide for the Enterprise Risk Assessment

Risk Assessment and Analysis

Ranking based on perceived risk impact and controllability

Internal control evaluation

Establishment of risk control methodology

Establishment and implementation of mitigation plan

Establish mitigation activities plan through internal control by risk ranking

Residual risk evaluation

-

4. RBA risk indicator reporting

Report operational risk indicators

Manual and automatic reporting indicator design

Report industry specific risk indicators

Manual and automatic reporting indicator design

KoFIU reporting

Create reporting files and establish reporting processes

Education Content

OCTASolution provides customized Education services according to the customer's level of understanding on AML and the degree of involvement in AML work. We also provide Educations for system users and operators to ensure smooth business progress after the system has been implemented

-

Project Launch

Anti-Money Laundering base Education on guidelines and regulations

-

Product Installation

1st Education on the use of the product

-

Implementation complete

User 2nd Education

System Operator Education -

Stabilization

User and Operator OJT (On site business Support)

Examples of AML work regulations Education for those heavily involved in anti-money laundering work

| Date | Time | Content |

|---|---|---|

| Day 1 | ||

| 1 | Characteristics of Anti-Money Laundering System Definition and Origin of Money Laundering Money laundering, crime, anti-money laundering International Anti-Money Laundering Organization Money Laundering Act Financial Information Analysis Research Institute |

|

| 2 | AML and RBA System Components Understanding the RBA System Overview of the Specific Financial Transactions Act Money laundering sanctions provisions |

|

| 3 |

Overview of the Act on reporting and using specified financial transaction information and the Enforcement Decree of the Act on reporting and using specified financial transaction information AML procedures - Internal Control AML procedures - customer identification

|

|

| 4 |

|

| Date | Time | Content |

|---|---|---|

| 2nd day | ||

| 5 | AML procedures - customer identification

|

|

| 6 | AML procedures - Customer Verification System(KYC)

|

|

| 7 |

AML procedures - High Risk Group EDD AML procedures - STR AML procedures - Reporting System AML procedures – Data preservation |

|

| 8 |

Amendment to the Enforcement Decree on the Act on reporting and using specified financial transaction information(VASP) Inspection list of financial supervisory services in 2020 |