FATCA-PRISM™ / CRS-PRISM™

FATCA/CRS(US and Multilateral Financial Information Exchange)

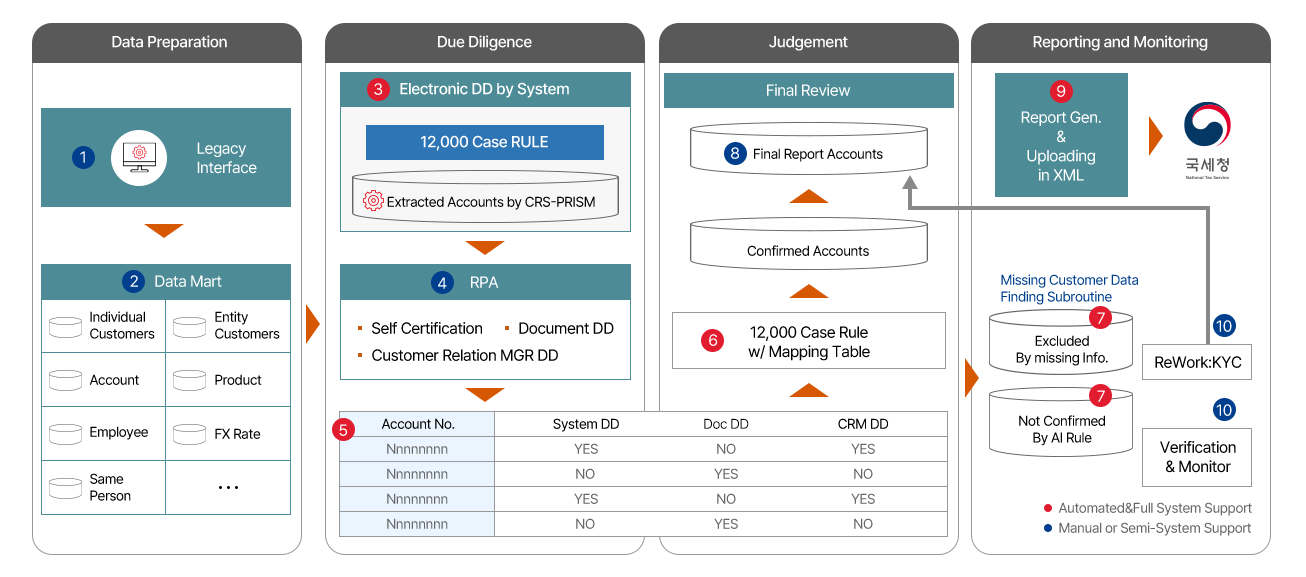

FATCA/CRS is a policy that identifies the account information of taxpayers by country such as United States or 100 other countries and report it to the National Tax Service under an intergovernmental agreement.

- Major Functions

-

- Extracting accounts of indicia (estimated taxpayers)

- Document due diligence, support for personnel due diligence

- Determining the final report target

- Generate reports in compliance with IGA and FATCA regulations and report to the NTS (automatic upload)

- Characteristics

-

- Approximately 11,000 Case rules are applied to automate target account extraction/judgment and improve accuracy